Beckett Grading Services, a once-renowned name in sports card grading, is currently experiencing a significant downturn. November statistics by grading analytics platform GemRate reveal a troubling trend as BGS graded only 32,000 cards—a 32% decrease from October and a 43% drop year-over-year. This marks a substantial decline from August when Beckett was only down by 13%.

The situation has been compounded by legal issues surrounding Greg Lindberg, the owner of Beckett’s parent company. Lindberg’s involvement in a $2 billion insurance fraud scheme has further destabilized the struggling grading company, shedding light on substantial financial instability. Court documents disclosed that Lindberg secured a $100 million loan against Beckett Grading Services, but BGS allegedly received a mere $500,000 from the loan. This mismanagement has raised concerns about the company’s recovery prospects, with the looming possibility of liquidation as Lindberg’s assets undergo scrutiny.

The scandal surrounding Lindberg has cast a shadow on Beckett’s future and shaken collector confidence, intensifying the challenges the company faces in maintaining its position in the competitive grading industry.

Beside the scandal, Beckett is grappling with the booming sports card grading market, where it has failed to capitalize on the industry’s growth. Among the “Big Four” grading companies, BGS stands as the only one experiencing a decline, with PSA’s year-over-year increase of 12%, SGC’s steady 7% growth, and CGC Cards’ impressive 32% rise pushing Beckett to fourth place. CGC, known for TCG and non-sport card grading, surpassed Beckett in sports card grading in November, despite sports cards representing only 13.1% of CGC’s total output, while they compose 60% of Beckett’s volume, highlighting the struggles Beckett faces in its primary focus area.

Despite challenges, Beckett has maintained relevance with its coveted Black Label 10s and Pristine 10s, which command premiums in the collector market, particularly among TCG enthusiasts like Japanese Pokémon and One Piece fans. However, this niche strength is insufficient to offset losses in high-volume grading, especially with competitors intensifying promotional efforts and Beckett’s traditionally higher pricing making it less competitive in the current market.

Traditionally known for grading iconic cards like the 1952 Mickey Mantle and the 1989 Upper Deck Ken Griffey Jr., Beckett’s diminishing role in grading these marquee items is evident in GemRate’s Iconic Tracker, showcasing a decline in Beckett’s grading activity for these legendary cards—an indication of its diminishing momentum in areas where it once excelled.

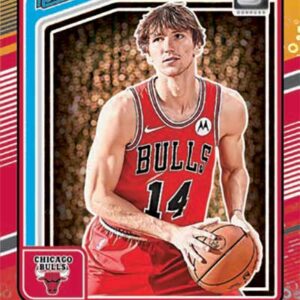

Amidst the challenges, Beckett remains competitive in high-end basketball cards, TCG grading, and Topps Now Cards. However, the company faces an uphill battle as its overall grading numbers continue on a downward trajectory, signaling underlying systemic issues that need to be addressed.

The future for Beckett Grading Services remains uncertain as the company grapples with legal entanglements, increased competition, and a decline in overall grading volume. While its reputation for premium grades remains valuable in niche markets, Beckett must adapt strategically to regain its standing in the industry and reverse its downward spiral. Industry observers and collectors alike eagerly await to see if Beckett can navigate these turbulent waters and emerge stronger amidst mounting adversity.