In a world where a single sports card can command the price of a luxury car, Canadian collectors have long wrestled with the challenge of safeguarding their treasures. Enter NFP, a leading property and casualty broker, with their newly announced safeguard designed specifically for the devotees of this niche – a meticulously crafted insurance program for sports memorabilia. In partnership with Berkley Asset Protection, this program promises to deliver a much-needed safety net covering the expanse from Gretzky to Bautista, through all errant pucks and home runs.

The brain behind this intuitive offering is none other than Greg Dunn, Managing Director of Personal Risk at NFP in Canada. Dunn pointed out an enduring issue: folks with burgeoning collections have been vastly underprotected under regular homeowners insurance schemes. According to him, these standard policies fail to embrace the intrinsic and escalatory value of sports collectibles. Consequently, significant gaps in coverage have left many collectors playing defense against potential losses. This stark reality catalyzed the formation of an insurance answer that would step off the bench and into the game, providing immediate peace of mind from the moment a new piece is added to a collection.

One of the pivotal features of this program is the automatic coverage for new acquisitions. Imagine nabbing a rare, signed Connor McDavid jersey at an auction only to lose it to an unforeseen event on the way home. Under NFP’s new coverage, such heartbreaking mishaps are intercepted by a proactive assurance that kicks in the moment a purchase is made. Additionally, transit coverage ensures that from point A to point B, whether it’s a cross-country shipment or a car ride across town, your new and existing collectibles are secure under the watchful eye of this innovative insurance.

Adding her expertise to the mix, Olivia Cinqmars-Viau, AVP of fine art underwriting at Berkley Asset Protection, emphasized the tailored nature of this insurance solution. Designed specifically with the collector in mind, the program adjusts dynamically to the fluctuating nuances of memorabilia valuation and collector habits. This bespoke approach acknowledges the unique status of sports memorabilia as more than just nostalgic keepsakes; they are potent financial assets requiring robust and responsive protection strategies.

Further endorsement comes from Steve Menzie, president and owner of the Sport Card & Memorabilia Expo, a cornerstone of Canada’s collectibles landscape. Menzie, who has seen the emotional and financial devastation of uninsured loss among collectors, sees this partnership between NFP and Berkley as a decisive step toward mitigating such risks. His words underscore the refrain that while the sentimental value of memorabilia is paramount, the monetary value cannot be ignored. Collectors invest substantial sums into their passion, and this new insurance vehicle allows them to play offense, securing their investments against all odds.

In the immediate future, NFP’s Personal Risk team plans to showcase this invaluable addition to the collector’s playbook at the upcoming Sport Card & Memorabilia Expo in Toronto. From April 25-28, attendees can explore firsthand how these tailored insurance solutions can play a critical role in their collecting strategy. This initiative is not just about launching a product but about heralding a new era of security and stability for the Canadian sports memorabilia community, further exemplified by NFP’s expansive commitment globally with over 8,000 personnel dedicated to specialized insurance solutions.

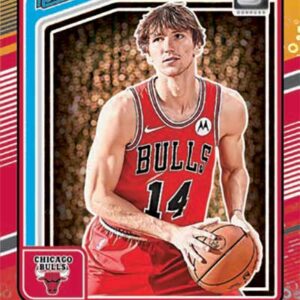

With this new program, the message is clear: your legacy of collectibles is more than just a hobby; it’s an asset worth defending. Whether your collection spans decades of hockey history or houses MVP basketball cards, NFP and Berkley’s dedicated coverage ensures your treasures are well-protected, leaving you to enjoy the thrill of the chase without the shadow of risk hanging over your prized possessions.